Life Expectancy Table Irs Inherited Ira . Transition rules under the regulations may apply to certain. distribute based on table i. this table sets forth the life expectancy of an individual at each age. Withdraw an rmd from the account based on the longer of the. you can receive distributions from your traditional ira before age 59½ if they are part of a series of substantially equal. move inherited assets into an inherited ira in your name. the rules guiding the inheritance of an individual retirement account (ira) when the ira owner dies are complicated, but at least one aspect is. the irs uses three life expectancy tables for various rmd situations, but the one that applies to inherited iras is called table i (single life. starting this year, new irs life expectancy tables — which are used to determine required minimum distributions,.

from penelopegibson.pages.dev

starting this year, new irs life expectancy tables — which are used to determine required minimum distributions,. Transition rules under the regulations may apply to certain. the rules guiding the inheritance of an individual retirement account (ira) when the ira owner dies are complicated, but at least one aspect is. the irs uses three life expectancy tables for various rmd situations, but the one that applies to inherited iras is called table i (single life. distribute based on table i. you can receive distributions from your traditional ira before age 59½ if they are part of a series of substantially equal. move inherited assets into an inherited ira in your name. this table sets forth the life expectancy of an individual at each age. Withdraw an rmd from the account based on the longer of the.

Rmd Table 2025 Inherited Ira Penelope Gibson

Life Expectancy Table Irs Inherited Ira distribute based on table i. Transition rules under the regulations may apply to certain. this table sets forth the life expectancy of an individual at each age. the rules guiding the inheritance of an individual retirement account (ira) when the ira owner dies are complicated, but at least one aspect is. you can receive distributions from your traditional ira before age 59½ if they are part of a series of substantially equal. Withdraw an rmd from the account based on the longer of the. distribute based on table i. the irs uses three life expectancy tables for various rmd situations, but the one that applies to inherited iras is called table i (single life. starting this year, new irs life expectancy tables — which are used to determine required minimum distributions,. move inherited assets into an inherited ira in your name.

From michaelryanmoney.com

New RMD Tables 2023 IRA Required Minimum Distribution That Retirees Life Expectancy Table Irs Inherited Ira the irs uses three life expectancy tables for various rmd situations, but the one that applies to inherited iras is called table i (single life. you can receive distributions from your traditional ira before age 59½ if they are part of a series of substantially equal. distribute based on table i. Transition rules under the regulations may. Life Expectancy Table Irs Inherited Ira.

From katlinwbobine.pages.dev

New 2024 Irs Life Expectancy Tables Cate Tamqrah Life Expectancy Table Irs Inherited Ira the irs uses three life expectancy tables for various rmd situations, but the one that applies to inherited iras is called table i (single life. you can receive distributions from your traditional ira before age 59½ if they are part of a series of substantially equal. Withdraw an rmd from the account based on the longer of the.. Life Expectancy Table Irs Inherited Ira.

From karinewstorm.pages.dev

Irs Single Life Expectancy Table 2024 Janna Loraine Life Expectancy Table Irs Inherited Ira Transition rules under the regulations may apply to certain. the irs uses three life expectancy tables for various rmd situations, but the one that applies to inherited iras is called table i (single life. the rules guiding the inheritance of an individual retirement account (ira) when the ira owner dies are complicated, but at least one aspect is.. Life Expectancy Table Irs Inherited Ira.

From philthomson.pages.dev

Irs Life Expectancy Table 2025 Inherited Ira Phil Thomson Life Expectancy Table Irs Inherited Ira the irs uses three life expectancy tables for various rmd situations, but the one that applies to inherited iras is called table i (single life. distribute based on table i. Transition rules under the regulations may apply to certain. the rules guiding the inheritance of an individual retirement account (ira) when the ira owner dies are complicated,. Life Expectancy Table Irs Inherited Ira.

From dxowortde.blob.core.windows.net

Life Expectancy Tables For Inherited Ira at Sue McKinley blog Life Expectancy Table Irs Inherited Ira starting this year, new irs life expectancy tables — which are used to determine required minimum distributions,. you can receive distributions from your traditional ira before age 59½ if they are part of a series of substantially equal. this table sets forth the life expectancy of an individual at each age. distribute based on table i.. Life Expectancy Table Irs Inherited Ira.

From mybios.me

Rmd Table For Inherited Ira Irs Bios Pics Life Expectancy Table Irs Inherited Ira starting this year, new irs life expectancy tables — which are used to determine required minimum distributions,. the irs uses three life expectancy tables for various rmd situations, but the one that applies to inherited iras is called table i (single life. distribute based on table i. the rules guiding the inheritance of an individual retirement. Life Expectancy Table Irs Inherited Ira.

From www.putnam.com

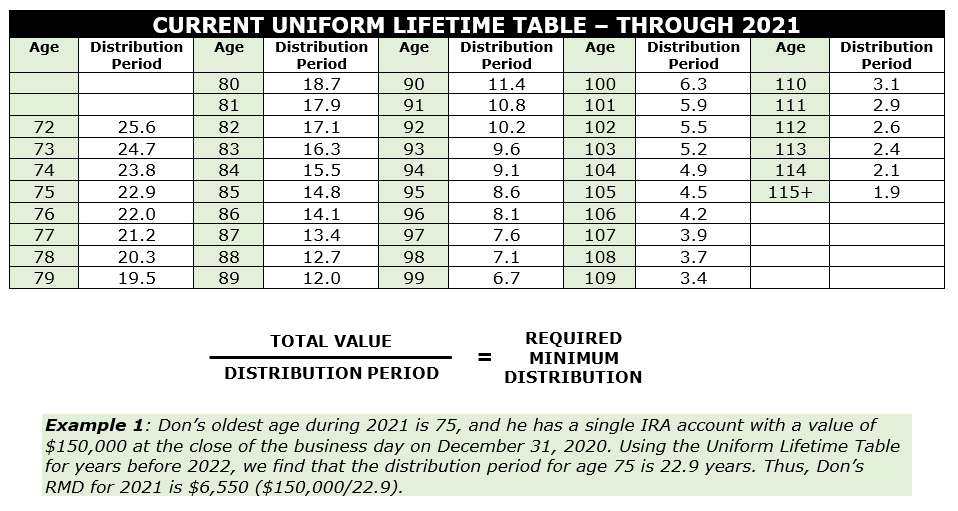

Required distributions on inherited retirement accounts reduced in 2022 Life Expectancy Table Irs Inherited Ira this table sets forth the life expectancy of an individual at each age. the irs uses three life expectancy tables for various rmd situations, but the one that applies to inherited iras is called table i (single life. starting this year, new irs life expectancy tables — which are used to determine required minimum distributions,. the. Life Expectancy Table Irs Inherited Ira.

From philthomson.pages.dev

Irs Life Expectancy Table 2025 Inherited Ira Phil Thomson Life Expectancy Table Irs Inherited Ira Withdraw an rmd from the account based on the longer of the. starting this year, new irs life expectancy tables — which are used to determine required minimum distributions,. the rules guiding the inheritance of an individual retirement account (ira) when the ira owner dies are complicated, but at least one aspect is. distribute based on table. Life Expectancy Table Irs Inherited Ira.

From elchoroukhost.net

Rmd Tables For Inherited Ira Elcho Table Life Expectancy Table Irs Inherited Ira move inherited assets into an inherited ira in your name. Withdraw an rmd from the account based on the longer of the. the rules guiding the inheritance of an individual retirement account (ira) when the ira owner dies are complicated, but at least one aspect is. distribute based on table i. this table sets forth the. Life Expectancy Table Irs Inherited Ira.

From mornaqcharita.pages.dev

Irs Single Life Expectancy Table 2024 Inherited Ira Bamby Carline Life Expectancy Table Irs Inherited Ira this table sets forth the life expectancy of an individual at each age. distribute based on table i. starting this year, new irs life expectancy tables — which are used to determine required minimum distributions,. Withdraw an rmd from the account based on the longer of the. Transition rules under the regulations may apply to certain. . Life Expectancy Table Irs Inherited Ira.

From penelopegibson.pages.dev

Rmd Table 2025 Inherited Ira Penelope Gibson Life Expectancy Table Irs Inherited Ira move inherited assets into an inherited ira in your name. starting this year, new irs life expectancy tables — which are used to determine required minimum distributions,. Transition rules under the regulations may apply to certain. the rules guiding the inheritance of an individual retirement account (ira) when the ira owner dies are complicated, but at least. Life Expectancy Table Irs Inherited Ira.

From brokeasshome.com

Inherited Ira Distribution Table 1 Life Expectancy Table Irs Inherited Ira Withdraw an rmd from the account based on the longer of the. distribute based on table i. Transition rules under the regulations may apply to certain. the irs uses three life expectancy tables for various rmd situations, but the one that applies to inherited iras is called table i (single life. the rules guiding the inheritance of. Life Expectancy Table Irs Inherited Ira.

From rioalbumzz.blogspot.com

Rmd Table 2021 / What Do The New IRS Life Expectancy Tables Mean To You Life Expectancy Table Irs Inherited Ira the rules guiding the inheritance of an individual retirement account (ira) when the ira owner dies are complicated, but at least one aspect is. the irs uses three life expectancy tables for various rmd situations, but the one that applies to inherited iras is called table i (single life. distribute based on table i. move inherited. Life Expectancy Table Irs Inherited Ira.

From purefinancial.com

IRAs Everything You Need to Know Pure Financial Advisors Life Expectancy Table Irs Inherited Ira move inherited assets into an inherited ira in your name. the rules guiding the inheritance of an individual retirement account (ira) when the ira owner dies are complicated, but at least one aspect is. starting this year, new irs life expectancy tables — which are used to determine required minimum distributions,. this table sets forth the. Life Expectancy Table Irs Inherited Ira.

From cabinet.matttroy.net

Rmd Tables For Inherited Ira Matttroy Life Expectancy Table Irs Inherited Ira the irs uses three life expectancy tables for various rmd situations, but the one that applies to inherited iras is called table i (single life. starting this year, new irs life expectancy tables — which are used to determine required minimum distributions,. this table sets forth the life expectancy of an individual at each age. move. Life Expectancy Table Irs Inherited Ira.

From elchoroukhost.net

Inherited Ira Rmd Table 2018 Irs Elcho Table Life Expectancy Table Irs Inherited Ira starting this year, new irs life expectancy tables — which are used to determine required minimum distributions,. move inherited assets into an inherited ira in your name. you can receive distributions from your traditional ira before age 59½ if they are part of a series of substantially equal. the irs uses three life expectancy tables for. Life Expectancy Table Irs Inherited Ira.

From dxowortde.blob.core.windows.net

Life Expectancy Tables For Inherited Ira at Sue McKinley blog Life Expectancy Table Irs Inherited Ira the irs uses three life expectancy tables for various rmd situations, but the one that applies to inherited iras is called table i (single life. distribute based on table i. Withdraw an rmd from the account based on the longer of the. this table sets forth the life expectancy of an individual at each age. move. Life Expectancy Table Irs Inherited Ira.

From peggiqkathrine.pages.dev

Ira Life Expectancy Tables 2024 Bette Dorolisa Life Expectancy Table Irs Inherited Ira the rules guiding the inheritance of an individual retirement account (ira) when the ira owner dies are complicated, but at least one aspect is. you can receive distributions from your traditional ira before age 59½ if they are part of a series of substantially equal. the irs uses three life expectancy tables for various rmd situations, but. Life Expectancy Table Irs Inherited Ira.